Estate Planning under the American Families Plan: Part 2

By John Owens, CFP, EA, ECA

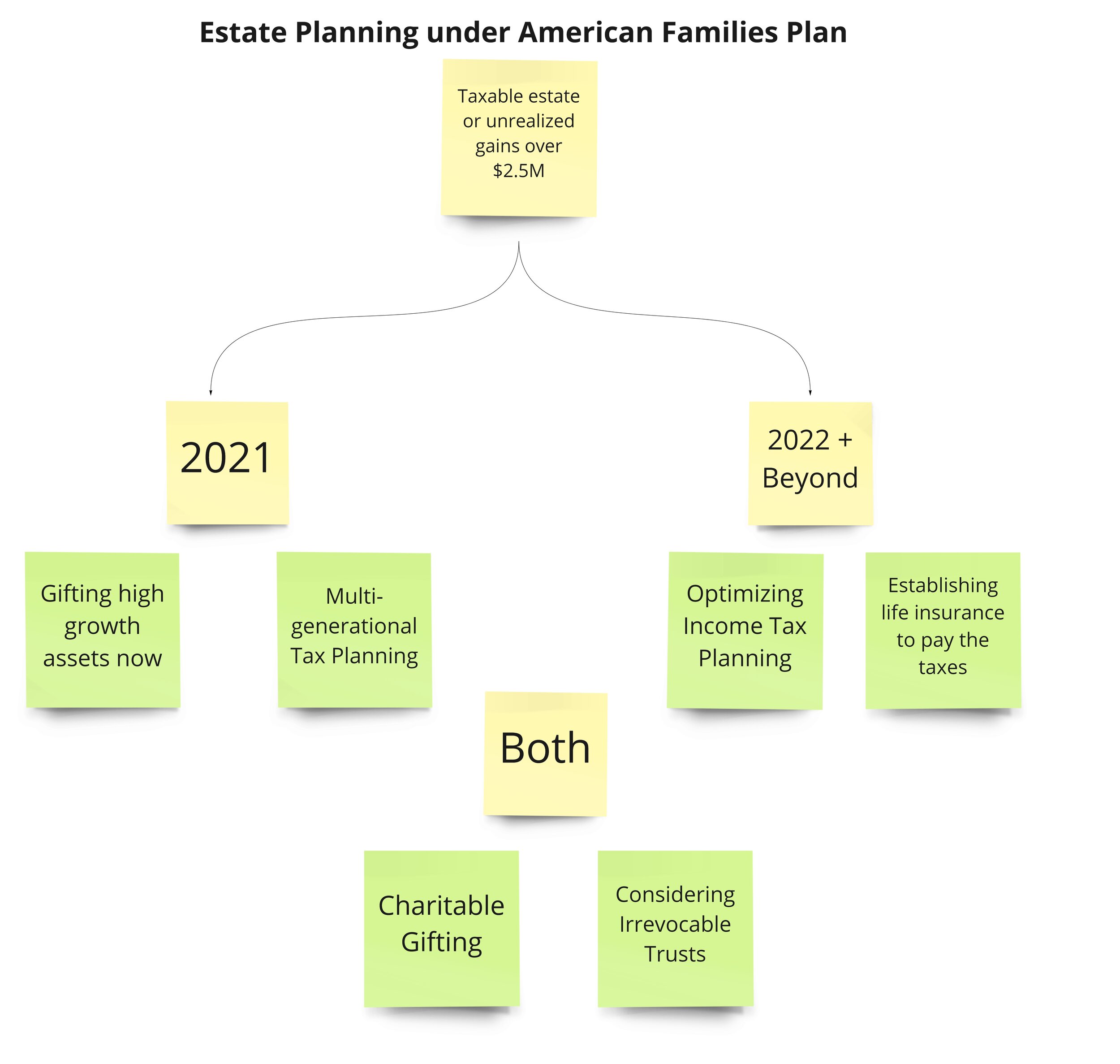

Last week we kicked off our discussion of the American Families Plan with an in-depth look at the income tax implications. Today we’ll dive into the far-reaching implications of this legislation on estate planning.

The impact on estate planning is significant, as the tax plan proposes making death a realization event (i.e. triggering income taxes on unrealized capital gains at death). It appears this will be subject to a $1M exemption, with the exclusion on capital gains for the sale of a primary home also remaining intact. As such, most couples can avoid capital gains tax on approximately $2.5M of unrealized appreciation at death.

A quick primer on the current estate tax rules, as most folks haven’t had to worry about this in recent years. US citizens have an estate tax exemption of $11.7 million in 2021. That also doubles as the gift tax and generation skipping tax exemption. That means that you can give away up to $11.7M over your life and death (combined) to non-spouse, non-charity beneficiaries and avoid paying estate taxes. And assets receive a step-up in basis at death to their fair market value when the owner passes.

The estate planning discussion for many taxpayers moves from one efficiently transferring assets and avoiding probate, to one of both efficiency and tax minimization.

Here’s a list of planning opportunities that come to mind:

1. Deferring Capital Gains via Gifts – With death becoming a realization event, and the step-up in basis being limited, one strategy to consider is gifting low-basis assets during life to avoid the tax on appreciation at death. This may come into play most commonly for closely held businesses that are highly valuable but were started many years ago and have a low cost basis. This strategy doesn’t eliminate the tax on the unrealized gains, it just may simply defer that tax longer.

2. Renewed Look at Permanent Life Insurance – If annuities are heresy in the fee-only planning world, then I’m not sure what we should call permanent life insurance. But if we see that unrealized appreciation will be taxed at death, one significant concern will be having liquidity to pay the tax bill. Permanent life insurance, such as whole life, can be a tool to build liquidity to assuage those issues. This has been a common estate planning tool for folks with taxable estates – but it may become more mainstream in this scenario.

3. Multigenerational Planning – One of the biggest considerations under this plan is the anticipated generational transfer of wealth of the next several years. With this in mind, we need to think about how a potential inheritance would impact the taxability of your estate, and whether there are tools we can use that mitigate the impact of this tax change. Not all assets are created equal – gains in stock in a brokerage account will be taxed immediately at death, yet stock in an IRA or 401(k) will not. It also is important to consider who will have the higher tax rate – the decedent or the heir – as you may want to optimize to decrease the family’s total lifetime tax bill – not just that of the heir or decedent.

4. Charitable Gifting – as a primary mechanism for reducing likelihood of paying estate taxes and income tax, charitable gifts will be all the more valuable under this new tax regime. Appreciated securities given to charity both lower the value of the estate – reducing the likelihood of estate taxes, and also don’t get taxed on their unrealized appreciation at death.

5. Irrevocable Trusts – these types of trusts can be used to help get appreciation out of your estate and minimize estate taxes. So instead of holding on to an investment that may be worth $1M today, that you think will grow 10-20x before it gets passed to heirs, putting that asset in an irrevocable trust now may help get that appreciation out of your estate, and potentially defer income taxes (and estate taxes) on that appreciation.

As you can tell, this is complicated and interconnected. We don’t even have the full context of the Biden plan just yet, only the broad strokes. So let me leave you with a bit of punditry of my own:

- It is very unlikely the final version of the plan looks like this. While it’s reasonable to see capital gains and income taxes increase, I’d be very surprised if they actually taxed long-term gains at 39.65.

- Triggering income taxes on unrealized appreciation at death would be a major shift in the tax code. I’m not saying it’s unlikely, but it’s complicated. There are many assets out there that don’t have a readily available cost basis – think land or stock acquired decades ago? Art? A family business? I see this as potential bargaining chip for a lowered estate tax threshold, perhaps.

- A big provision of this plan is enforcement for the IRS. There are a lot of tax cheats out there, and studies show that each dollar spent on enforcement can bring in almost $7 in new revenue. Expect lots more letters from the IRS, Audits, and scrutiny if this gets passed.

In the meantime, the next steps for most folks are as follows:

1. Review your financial plan, estate plan, and balance sheet. If you don’t have any one of those, it’s time to get one.

2. Talk to your trusted advisors about how this proposal may impact you and what changes may need to be made to your plans to prepare.

3. Start talking to your parents and/or children about how this impacts them. Nothing like higher taxes that can bring the whole family together.

4. Assess your goals and update strategies as needed based on what happens in Washington. Look for moves that make sense under the current and proposed tax regime.

At Brooklyn FI, we stand ready to help our clients navigate these changes. We’re following this legislation closely and constantly developing ways to help our clients in an ever changing environment.