How Much Do I Need to Save for College? ..and other important questions.

Step right up folks, we’ve got some fun content here to break through the noise related to saving for college.

The best time to start saving for your child’s education was yesterday, the second-best time is tomorrow. What an annoying and condescending platitude that is! But in all seriousness, when we’re talking about needing a lot of money for something in the future, the best time to start saving for it is …as soon as possible. That way we can let the power of compound interest do its thing.

So, how much does college cost?

If your baby was born yesterday, you have about 17 years to save for that baby’s freshman year of college which takes place in the year 2039. YIKES!

We use an assumption that college costs will continue to rise FASTER than inflation.

Let’s look at an example:

Mary-Kate was just born

Her parents would like her to attend the country’s finest educational institution: Skidmore College

With the rising cost of college + inflation, we can expect college to cost more than $175,000 a year ...18 years from now.

Her parents need to save ¾ of a million dollars

So I need to save a lot of money…where should I do that?

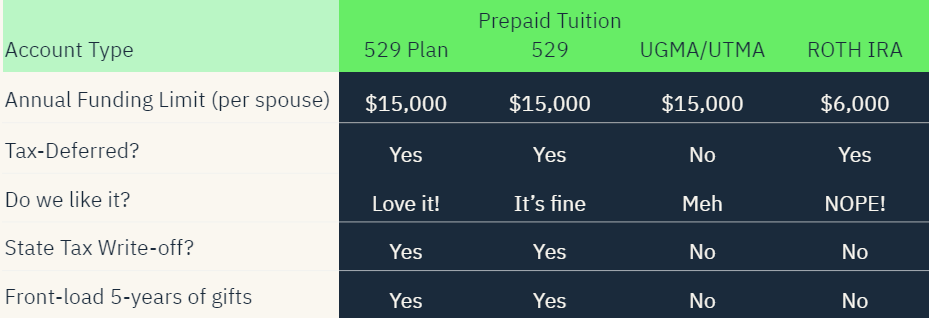

Well, you have quite a few choices. Here is a visual display of the savings accounts typically used for college funds.

At Brooklyn FI, we believe the best place to save for college is the 529 college savings plan. These state-run investment accounts are not only tax-deferred (meaning the interest and dividends are not taxed annually as it grows), but are flexible enough to cover lots of expenses related to education.

Here is everything you’ve ever wanted to know about 529 plans

Contribute to an education fund and watch your funds grow tax free.

Your money will be invested in index funds at a very low cost.

Get a tax deduction of up to $5,000 per spouse for New York state.

You can use the money to pay for college tuition and supplies tax free.

In New York, as of 2020, the maximum amount you can have in a 529 plan is $520,000

If the first child doesn’t use the money, the beneficiary can be changed to a close relative (sibling or grandchild).

Anyone can contribute to your kid’s 529 Plan!

The American education system is broken, what if my kid wants to go to school in Europe or Asia? Can I use 529 dollars abroad? YES. Schools like the University of Melbourne, Oxford, University of Leeds, Hong Kong University, and Ben-Gurion University are on the official list of “Eligible Educational Institutions.” Check out an updated list.

You can use the 529 dollars for “Qualified Education Expenses”

Tuition and fees

On campus meal plans

Books and supplies required

Laptops + required software for class

Beer (just kidding)

Room and board

Some accredited vocational schools (cooking school anyone)

SOME STATES (not NY): private elementary and high schools

If this short summary whetted your whistle, sit back and watch two of our senior advisors ham it up about saving for college.