Brooklyn Fi For Artists

Financial Planning, Investing, & Tax Strategy For Creative Professionals

You have a manager guiding your career.

An agent negotiating opportunities.

An attorney reviewing contracts.

But who is overseeing your financial life?

At Brooklyn Fi for Artists, we provide comprehensive financial planning, investing, and tax strategy for singers, producers, songwriters, and creative entrepreneurs whose careers are accelerating or are already operating at scale.

We design sophisticated strategies that transform peak earning years into lasting wealth.

You focus on the art.

We structure, protect, and grow what it creates. We help with decisions like: where should I invest my money? Can I afford to buy this house? How can I make this windfall last?

Whether you’re emerging into national visibility or navigating significant earning years, we tailor financial planning to the unique volatility and opportunity of an artist’s life, aligning today’s success with long-term security.

We build tax-efficient, diversified portfolios designed to balance career volatility with long-term growth, turning high-earning years into enduring wealth.

From complex royalty streams to multi-state income and entity structuring, we provide proactive tax strategy so there are no surprises, only preparation.

We manage cash flow, coordinate with your business team, and ensure your financial infrastructure supports both your personal life and your career expansion.

We design comprehensive plans that integrate investing, real estate, liquidity planning, and long-term wealth strategy. So your success today supports financial independence tomorrow.

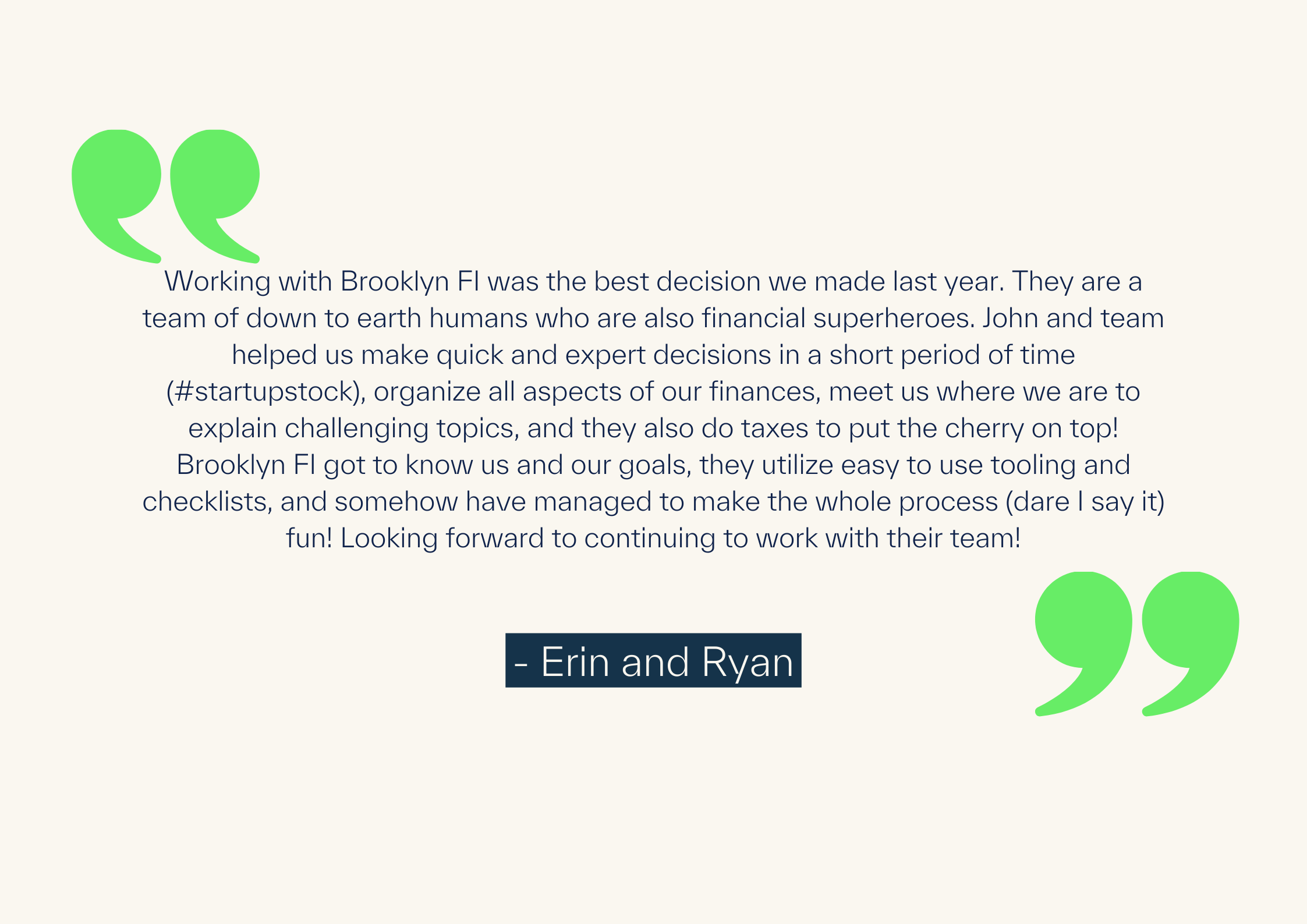

All testimonials and/or endorsements have been provided by real current and/or former clients. No current or former client was compensated, directly or indirectly, for providing these statements. Brooklyn Fi, LLC gained each client's permission to publish their testimonial/endorsement.

IRA? Roth? SEP?

Covered.

Investments?

Locked down.

Stock options?

Inside and out.

Cash-flow?

We run a tight ship.

Insurance?

A full needs analysis.

Wanna buy a home?

Just say when.

Credit score?

850 or bust.

Tax planning?

Our favorite pastime.